- Version

- Download 83

- File Size 5.21 MB

- File Count 1

- Create Date September 2, 2021

- Last Updated September 2, 2021

A Guide to Your CariCARE Plan

WHEN COVERAGE STARTS

WHO IS ELIGIBLE FOR COVERAGE?

EMPLOYEES

You are eligible if you are an Employee (see Definitions).

DEPENDENTS

Your eligible Dependents are:

- Your spouse of the opposite sex, legally married or common law.

- Your unmarried children under age 19.

- Your unmarried children under age 25 who are registered students in regular full-time attendance at a recognized school or university.

Your dependents must reside in the same country as you and be registered on the records of the Employer.

Children include stepchildren and legally adopted children.

If husband and wife are both eligible as Employees, only one may cover their dependents.

RETIREES

- Eligible employees will be employees who have completed at least ten (10) years of service.

- All active employees over the age as set forth in the Schedule of Benefits and retirees who are eligible for coverage would be expected to join the program.

- The benefit period for this coverage shall be as stated in the Schedule of Benefits.

The Major Medical Maximum will reduce as stipulated in the Schedule of Benefits at the age as set forth in the Schedule of Benefits or retirement whichever is first. All other benefits would remain unchanged.

YOUR COVERAGE

Coverage starts on the later of:

- The Effective Date of this Group plan, if you started work on or before this date.

- The first day of the month after you have completed your waiting

- The date when immediate coverage is requested on your behalf and approved by Sagicor Life Inc.

If you are away from work on the date coverage should start; coverage will not start until you return to full-time work.

YOUR DEPENDENT'S COVERAGE

You must enroll for the coverage for your Dependents (see How To Enroll).

Coverage starts on the latest of:

- The date you become covered.

- The first day of the month after you acquired your first Dependent.

- The date you enroll for the Dependent coverage.

- The date your Dependents are approved by Sagicor Life Inc. for

If a Dependent is confined in a hospital or other institution when coverage should start, the Comprehensive Medical benefit will not start until:

- Sagicor Life Inc. is given proof that the Dependent has completely

HOW TO ENROLL

You enroll by filing a written request with your Employer to deduct the required contribution from your pay.

If you do not have a Dependent when you become covered, you may enroll for the Dependent's benefits when you acquire your first Dependent.

For coverage under the CariCARE@ plan, Sagicor Life Inc. must be notified within thirty-one days of having a new Dependent.

Proof of insurability acceptable to Sagicor Life Inc. of each of the persons to be covered must be given if you enroll them after one month from the time they become eligible.

In the event an employee's waiting period is waived evidence of insurability satisfactory to the insurer must be presented.

For coverage under the CariCARP Enterprise plan, proof of insurability must be given for all Insureds. This also applies if the policyholder of your plan is an Association or Union.

If the proof of insurability is not acceptable to Sagicor Life Inc., that person will not be considered as an Insured under the Plan. No benefit will be paid.

WHAT THIS PLAN COVERS

GROUP HEALTH

A serious illness is arduous enough without the worries of financial hardship. Sagicor Group Health products will alleviate the concerns of

you and your loved ones allowing you to concentrate on the important things in life.

HOW THE GROUP HEALTH PRODUCT WORKS

The Sagicor Group Health plan provides benefit, within certain parameters, in the event of medical illness. Dental and Vision can be added to the medical benefit as an option. These additional benefits will be stated in the Schedule of Benefits.

HOW SAGICOR GROUP HEALTH PRODUCT BENEFITS YOU

Discover a range of coverage that may include:

- Extensive Major Medical coverage

- Doctors° Visits

- Transplant procedures

- Psychiatric Care

- Hospital Room and Board

- Preventative Care

- Maternity Coverage

- Emergency ambulance/air transportation

- Emergency travel assistance programme

- Hearing Aids benefit and

- Repatriation of mortal remains

OPTIONAL COVERAGES

GROUP LIFE

Life Insurance is an excellent addition to any employee's benefit packages. Sagicor's Group Life Insurance products are designed specifically to provide peace of mind and financial protection to an employee and their immediate family in the event of his/her untimely passing. These benefits may be used to cover funeral expenses or help provide for a family's loss of income.

Your Life Insurance Amount is as stated in the Schedule of Benefits.

ACCIDENT DEATH & DISMEMBERMENT OPTIONAL RIDER TO LIFE

Your Accidental Death & Dismemberment Benefit may be equal to (if elected) your Life Insurance amount and subject to the same requirements for evidence of insurability.

Your Accidental Death & Dismemberment Benefit terminates as stated in your Schedule of Benefits. Policyholders can elect to add Accidental Death and Dismemberment coverage.

DENTAL

The Dental Care Rider will reimburse you and your dependents for the charges

incurred for necessary dental care performed by a dentist or a qualified dental hygienist, up to the maximum stated in the Schedule of Benefits. Reimbursement will be made for charges not exceeding the Maximum Allowable Expense in excess of the deductible and subject to the respective co-insurance factors. A charge will be considered to be incurred on the date the service is rendered, rather than on the date the payment is made.

Policyholders can elect to add Dental coverage.

VISION

This Vision Care Rider benefit provides for the reimbursement of expenses incurred for necessary vision care treatment and supplies which are recommended by:

- A duly qualified and licensed Optician

- Optometrist or

- Ophthalmologist

up to the amounts shown in the Schedule of Benefits.

Policyholders can elect to add Vision coverage.

GROUP HEALTH

COMPREHENSIVE MEDICAL BENEFIT

MAXIMUM BENEFIT

The Maximum Benefit payable for you or any Dependent is shown in the Schedule of Benefits. You may use all or part of the Maximum Benefit.

The Comprehensive Medical Benefit provides payment for a wide range of medical expenses (called Covered Expenses). These expenses must be charged to you or your Dependent while covered.

These expenses must relate to the Covered Expenses under this Benefit.

COVERED EXPENSES

Covered Expenses are the actual cost to you of the Reasonable Charges

for the services and supplies listed below. The service or supply must be:

- Medically necessary as a result of a covered illness or injury.

- For services, treatment or supplies incurred during a period of

- Recommended and approved by the attending physician.

MEDICAL CARE AND TREATMENT

- These can be services such as Hospital, office or home visits. These can also be emergency room treatment services.

- Professional services of a graduate registered nurse when medically

- Charges for medically necessary ground ambulance service to and from a local hospital.

- Hospital charges for Room and Board for Semi-private or ward

*Charges may be made for a private room up to the Hospital's regular daily charge for a semi-private room.

- Other Hospital Services and Supplies (must be itemized or subject to 60% of total charges).

- Physician's or Surgeon's Services.

- Professional services of a licensed physiotherapist or a licensed chiropractor (except any such physiotherapist or chiropractor who is a relative of the employee or insured patient).

- Services for Surgical procedures.

- X-ray and Laboratory Tests for diagnosis or treatment.

- Radiation Therapy and chemotherapy charges.

- Charges for complications of pregnancy not covered by the Maternity Benefit.

- Anaesthetics and charges for administering same.

- Medical Supplies recommended by the Attending Physician.

- Prescribed drugs and medicines.

- Dental treatment (excluding orthodontia and periodontia) which is necessitated by and the direct result of an accidental injury to sound natural teeth and which is rendered to the insured within 90 days of the date of the accident.

- Surgical supplies such as bandages and dressings (must be itemised or subject to 60% of total charges).

- An appliance which replaces a lost body organ or part or helps an impaired one to work. An example is an artificial limb or eye. Only the first charge for the first appliance is covered.

- Oxygen and charges for administering same (this includes rental of required equipment).

- Rental of a wheel-chair or hospital-type bed or iron lung.

- Blood or blood plasma only if not donated.

- Preventative Care Benefit - (Not subject to the Individual deductible).

Upon receipt of due proof that an insured person has incurred eligible expenses for Preventative Care as specified in the Schedule of Benefits Sagicor Life Inc. will pay a benefit equal to the fees actually incurred not exceeding the maximum amount stated in the Schedule of Benefits.

LIMITATIONS FOR PRE-EXISTING CONDITIONS

An insured person may have received medical care or treatment for an injury or sickness at any time during the 3 months before coverage starts under this Plan.

Coverage under this policy for pre-existing conditions will be limited to

the amount specified in the Schedule of Benefits for twelve (12) months.

GENERAL EXCLUSIONS AND LIMITATIONS

No payment shall be made under any of the health benefits provided by this Policy for any claim resulting from any of the following:

- A sickness, injury or disability for which the insured person is not under the continuing care of a physician

- Expenses incurred as a result of:

- intentionally self-inflicted injury of any kind while sane or insane; any voluntary inhalation of gas or fumes or intake of poisonous substance;

- bodily injuries resulting directly or indirectly out of or in the course of war or hostilities of any kind or any act incidental thereto whether war be declared or not and regardless of whether or not the insured was participating therein, any insurrection, strikes, riots, civil commotion or service in the armed forces of any country or international governmental body;

- the commission of or attempt to commit any criminal offence; and

- any occupational injuries or sickness for which the insured person's employer is liable.

- Expenses incurred for injury or sickness arising out of circumstances in which a person or body corporate is liable to the insured person whether such liability is insured under a policy of indemnity or not; expenses for any services; treatment or supplies incurred as a result of an injury where there is a right of recovery against the person or other party who caused the injury.

- Any examination or charge in connection with general dental care or other dental work (except in cases of accidental injury to sound natural teeth provided such dental work was performed within 90 days of the accident) or for any eye examination or for the purchase or fitting of eyeglasses or contact lenses or for any surgery to correct vision which can otherwise be corrected by lenses or for hearing aids or other artificial aids or the examinations in connection therewith.

- Travel for health or periodic health examinations or any examination required for the use of a third party, expenses for any incidental personal comfort items and any medically unnecessary service or supply or for the treatment of any condition not causing sickness or not resulting from bodily injury.

- Expenses relating to treatment from substance abuse including alcoholism abuse, alcoholism or any kind of drug addiction.

- Any expenses related to the inducement of pregnancy or to effect or treat impotence or loss of libido or to determine the cause of non-fertility.

- Expenses incurred for tubal ligation, vasectomies or any other means of birth control whether for contraception or other purposes.

- Cosmetic surgery, including treatment for the complications of such surgery, unless the surgery is undertaken:

- for the purpose of reconstructing the shape or appearance of a part of the body which was impaired by a medically necessary surgery or treatment covered by this Policy; or

- to repair or alleviate damage caused by accidental bodily injury covered by this Policy within 90 days of the accident causing the injury (unless proven to not have been possible within this period) or unless for the purposes of correcting congenital anomalies.

- Charges levied by a physician for his time spent travelling or for his transportation or for broken appointments or for completion of claim forms or for advice given by him via telephone or other means of telecommunication or for the administration of vaccines or antitoxins or injections for immunization.

- Expenses for any services or treatments rendered to an insured person to the extent of any benefits payable under any governmental plan of health insurance if at the time such services or treatments are rendered the insured person is eligible to enroll in or is insured by such a governmental plan.

- Charges for well-baby care and hospital daily room and board and nursing care of a newborn infant before his discharge from hospital.

- Charges for treatment which the regulatory bodies consider experimental and which is not accredited by an international regulatory body.

- Charges rendered for professional services to a patient by any person who is ordinarily resident in the insured's home or who is a relative of the patient.

- Expenses for hospital services or for any other service or supply for which the insured is not required to make payment or for which there is no cost for any other reason; expenses incurred for which no charge is or would have been made in the absence of insurance.

- Expenses for a dependent child relating to pregnancy, miscarriage, caesarean section or post-natal care.

- Any charges in excess of the usual reasonable and customary charge for the service, treatment or supply provided or in excess of such charges as would have been made in the absence of this insurance.

- Charges for any treatment, supplies or services incurred before or commencing from any date before an insured's insurance commences under this Policy; any charge for any treatment, supply or service incurred after the termination date of any insured person's insurance.

- Medical treatment abroad unless it is proved to the satisfaction of Sagicor Life Inc. prior to treatment that such treatment is not available locally and that such treatment abroad was recommended by two physicians, at least one of whom shall be a specialist in the particular field of medicine pertaining to the insured's sickness or Expenses incurred due to this referral will be evaluated for benefit under the terms of this Policy based on the reasonable and customary limits of the nearest overseas source where the services are available.

- Any expense for male or female sterilization, reversal of sterilization, gender reassignment, sexual transformation, birth control, infertility, artificial insemination, sexual dysfunction or inadequacy.

LIMITATIONS ON COVERED EXPENSES FOR MENTAL ILLNESS There are limits on Covered Expenses for Mental Illness.

- The percentage of Covered Expenses payable by the Plan for confinement for mental illness is the same as any other sickness. It is shown in the Schedule of Benefits.

- No payment will be made under this benefit for expenses incurred for the treatment of mental illness while the insured is not confined in hospital except as specifically provided in the Schedule of Major Medical Benefits.

The Maximum Benefit payable for you or any Dependent is shown in the Schedule of Benefits. This maximum applies to each person's Lifetime.

DEDUCTIBLES

Your benefit is subject to a deductible.

INDIVIDUAL DEDUCTIBLE

The Individual Deductible is the amount of Covered Expenses you must first pay each year.

Each covered person must satisfy an Individual Deductible each Calendar Year before any payment is made. Once the deductible has been satisfied the plan pays the percentage of Covered Expenses shown in the Schedule of Benefits for the rest of the year.

The amount of the Individual Deductible is shown in the Schedule of Benefits.

Your plan may have a carry-over feature.

FAMILY DEDUCTIBLE

if the required number of individual deductibles, as stated in the Schedule of Benefits are satisfied, then the Individual Deductibles for all Covered Family Members will be satisfied for the rest of the same year.

COMMON ACCIDENT FEATURE

If two (2) or more Insured Members of a covered family are hurt in the same accident, only one Individual Deductible will have to be paid. This covers all of the combined daily expenses due to that accident during that year.

After the family deductible limit is satisfied no further major medical deductible is required for the remaining insured persons in the family.

CARRY-OVER FEATURE (where applicable)

Any Covered Expenses a person has incurred during October, November or December of a year which count toward that person's Individual Deductible for that year will also count toward that person's Individual deductible for the next year, provided that no benefits have been paid after satisfying the deductible for the previous calendar year.

MATERNITY BENEFIT

This benefit applies only to female employees and spouses of male employees who have enrolled for the dependent’s benefits.

The benefit pays for Covered Charges made to the persons shown above while covered. The charges must be made due to pregnancy from conception up to delivery.

COVERED CHARGES

The following are covered charges:

- Hospital charges for Room and Board.

- Hospital charges for Other Services and Supplies.

- Charges made by a government operated clinic or delivery room for Other Services Supplied.

- Charges made by a surgeon for performing one of the surgical procedures listed in the Schedule of Pregnancy Benefits shown in the Schedule of Benefits.

- Reasonable charges for ground ambulance to and from the Hospital, clinic or delivery room. (The charges must be made by a professional ambulance service.)

- Reasonable charges for anesthetics and for the anesthetist.

There is a Maximum Benefit for one pregnancy per year. It is shown in the Schedule of Benefits.

After termination of coverage, benefits will be paid for a pregnancy that commenced while the person was covered except in cases where the Policy Contract terminates.

NOT COVERED

- Charges made in connection with a Hospital confinement, which is not medically necessary.

- Any charges in excess of the amount shown in the Schedule of Benefits for pregnancy.

- No benefit is payable for pregnancy in respect of any insured whose pregnancy existed on or before the effective date of her insurance provided however that a female employee or the spouse of a male employee who is insured within 31 days of the effective date of this Policy is insured for pregnancy in existence on the effective date of this Policy.

MEDICAL AIR TRANSPORTATION BENEFIT

PAYMENT OF BENEFIT

This service affords the insured air transport outside the insured's country of residence for the purposes of obtaining medical care when this treatment is medically necessary and not available in your country of residence.

Sagicor Life Inc. must be notified for any services related to overseas treatment. If advance notification of overseas treatment is not furnished to Sagicor Life Inc. as required and the overseas treatment not certified, local benefit limits restrictions will apply.

Upon receipt of due proof that an insured person:

- requires necessary medical treatment in a country overseas as a result of sickness or injury while insured under this Policy, Sagicor Life will provide a benefit covering expenses for transportation by air ambulance for the insured person to and from the nearest hospital where the necessary treatment was provided.

or

- has incurred eligible expenses for necessary treatment by a physician overseas as a result of sickness or injury while insured under this Policy Sagicor Life Inc. will pay a benefit equal to the cost of transportation byair (as defined later) of the insured person to and from the hospital where the necessary treatment was provided.This benefit shall be limited to not more than twice in any one (1) calendar year or as set out in the schedule of benefits.Necessary medical treatment will have to be recommended in writing by 2 physicians at least 1 of whom is a specialist in the particular field of medicine pertaining to the sickness or injury from which the insured person is suffering. Such proof must be submitted to Sagicor Life Inc. prior to the treatment except in the case where emergency treatment is required and the insured person is outside of their country of residence.

Where an insured person takes ill or is injured outside of his country of residence and is hospitalized for more than 7 days such insured person may select a relative to be flown by regular scheduled airline paying economy fare and using the shortest route to and from the nearest hospital where the necessary medical treatment is being provided.

"Cost of transportation by air" means the economy fare charged by a regular scheduled airline using the shortest route to the nearest hospital where the necessary medical treatment can be provided.

TRANSPORTATION OF ESCORT

Arrangements will be for the member's spouse, family member or companion to accompany the individual being transported by air ambulance, should space permit.

REPATRIATION/ RECUPERATION

Should the patient and his treating physician determine that recuperation nearer home is feasible, air transportation will be provided.

ORGAN RETRIEVAL

Should a member require a heart, heart/lung, liver, kidney, lung or pancreas transplant, the organ will be transported by Air Ambulance.

ORGAN RECIPIENT TRANSPORTATION

Should time or medical constraints require, the Air Ambulance would fly the organ recipient candidate.

RETURN TRANSPORTATION

Included in member services are the arrangements and air transportation for the member's return home.

MINOR CHILDREN RETURN

Accident or illness by a parent could result in minor children being stranded. The Air Transportation Benefit will cover the cost of air transportation back home. When necessary, an attendant will ensure their safe return home.

MORTAL REMAINS

The Air Transportation Benefit will provide air transportation for the return of the member's remains whether as a result of accident or sickness.

PRE-NOTIFICATION REQUIREMENT

For any services related to overseas treatment you are required to notify Sagicor Life Inc. at least 10 days prior to the services being performed except in emergencies.

DENTAL CARE RIDER

The Dental Care Rider will reimburse you and your dependents for the charges incurred for necessary dental care performed by a dentist or a qualified dental hygienist, up to the maximum stated in the Schedule of Benefits. Reimbursement will be in accordance with the limits shown in your Schedule of Benefits in excess of the deductible and subject to the respective co-insurance factors. A charge will be considered to be incurred on the date the service is received, rather than on the date the charge is made.

ELIGIBLE EXPENSES:

Eligible expenses are limited to the following:

Level 1 - Preventative

- Oral examination including scaling and cleaning of teeth, but limited to one examination in any one six (6) month period.

- Dental x-rays, except that bitewing x-rays are limited to any one set in any one six-month period and full mouth x-rays are limited to one set in any twenty-four-month period.

- One (1) application of fluorides and other ant cariogenic substances in any one 12-month period.

Level 2 - Restorative

- Initial provision of amalgam, silicate, acrylic, synthetic, porcelain or composite restorations.

- Replacement of amalgam, silicate, acrylic, synthetic, porcelain or composite restorations, provided that, unless an additional tooth surface is involved, a continuous period of at least twelve consecutive months has elapsed since the date on which the restoration was last provided or replaced.

- Extractions (except for Orthodontia).

- Treatments for periodontal and other diseases of the gums and tissues of the mouth.

- Initial provision and installation of space maintainers.

- Drugs and medicines requiring written prescriptions and dispensed by a licensed pharmacist.

- Oral surgery of a dental origin (except for Orthodontia).

- Use of operating theatre of a private hospital for oral surgery of a dental origin at a charge not exceeding the limit as stated in the schedule of benefits.

- Physician's charges for the administration of general anesthesia during oral surgery of a dental nature at a charge not exceeding the limit as stated in the schedule of benefits.

Level 3 - Major Restorative

- Endodontic Treatment (including root-canal therapy).

- Initial provision of crowns and gold inlays or gold onlays, provided that the tooth is broken down by decay or traumatic injury, so that the tooth structure cannot be restored by amalgam, silicate, acrylic synthetic, porcelain or composite restoration.

- Replacement of crowns, gold inlays or gold onlays provided that the tooth is further broken down by decay or traumatic injury and only if:

-

- the tooth structure cannot be restored with amalgam, silicate, acrylic, synthetic, and porcelain or composite restoration;

- an additional tooth surface is involved or

- a continuous period of at least twelve consecutive months elapsed since the date the gold inlay or onlay being replaced was last provided or replaced.

- Initial installation of full dentures, partial dentures, or fixed bridgework provided that the appliance is required to replace one or more natural teeth at least one of which was extracted after the individual's date of coverage (commonly referred to as Open Space Limitation).

- Relining of, or any adjustments required to be made to new dentures provided that a period of at least twelve months has elapsed since the date the dentures were last provided.

- Repair of dentures.

- Addition of teeth to existing dentures or fixed bridgework provided that such addition is required to replace one or more natural teeth, at least one of which was extracted after the individual's effective date of coverage.Provided that:

- Such replacement or addition is required to replace one or more natural teeth at least one of which was extracted after the individual's effective date of coverage.

- The existing or fixed bridgework was installed at least five years prior to its replacement and cannot be made serviceable. Replacement of:

-

- an existing full denture.

- an existing partial denture.

- an existing fixed bridgework.

- Installation of Dental Implants to replace a tooth and any complications which may arise as a result of this procedure.

LIMITATIONS AND EXCLUSIONS: DENTAL

In addition to the General Limitations under the medical plan, no amount is payable under this benefit for charges incurred:

- For the CariCAPP Enterprise plan, no benefits will be paid for service incurred during the period stipulated in the schedule of This does not apply to the CariCARE® plan.

- For education or training in, and supplies used for dietary or nutritional counselling, personal oral hygiene or dental plaque control.

- For procedures, appliances or restorations used to increase vertical dimension or to restore occlusion.

- For replacement of dentures which are mislaid, lost or stolen.

- For or in connection with orthodontic treatments, including correction of malocclusion.

- For a course of dental care, which commenced prior to the effective date of an insured's individual insurance under this benefit, including charges for any crown, bridge or denture ordered prior to such date.

- For devices and supplies which are for cosmetic purposes or for experimental treatment or for unnecessary care or treatments, including duplicate dentures or bridges and temporary crowns, bridges or dentures. Where a dental procedure is performed for both functional and cosmetic purposes, that part of the procedure performed for cosmetic purposes will be excluded.

- For failure to keep scheduled dental appointment or for completion of any insurance forms.

- For pulp vitality tests, study model or precision attachments.

- For replacement of existing prosthetic devices unless the device is installed five or more years prior to replacement and in the opinion of the attending dentist is no longer serviceable.

- For any extra charge made for metal dentures.

- Expenses incurred for Hospital Care other than benefits covered by the Plan.

- Dental care which is not prescribed by a dentist or performed by a dentist or a dental hygienist.

VISION CARE RIDER

This rider provides for the reimbursement of expenses incurred for necessary vision care treatment and supplies which are recommended by duly qualified and licensed Optician, Optometrist or Ophthalmologist up to the amounts shown in the Schedule of Benefits subject to the limitations listed below.

LIMITATIONS AND EXCLUSIONS: Vision Care

No amount is payable under this Rider for charges incurred for:

- more than 1 of the following:

- complete visual examination including refraction during any one 12-month period;

- set of prescription lenses or contact lenses during any one 12-month period or

- set of frames during any one 24-month period.

- sunglasses whether plain or prescription or any tinted glasses with a tint other than No. 1 or 2;

- special procedures for orthoptics visual training subnormal vision or medical or surgical treatment of the eye except LASIK (Laser-Assisted In Situ Keratomileusis), where the surface of the cornea is reshaped to correct certain refractive disorders such as myopia and treatment / surgery occurs once during any 5 year period;

- treatment incurred as a result of any sickness or bodily injury arising out of or in the course of an insured person's employment;

- replacement of lost or broken lenses and/or frames duplicate glasses or lenses or frames;

- contact lenses unless medically required by an insured person:

- following cataract surgery or

- if visual acuity in an insured person's better eye is not correctable to 20/70 by the use of conventional type lenses but can be corrected to 20/70 or better by the use of contact lenses;

- contact lenses not prescribed or cosmetic.

- appointments which an insured person fails to keep.

- appointments for the completion of any insurance claims forms, or

- services or materials not listed in the Schedule of Benefits.

TERMINATION OF RIDER

All benefits terminate on the effective date of termination of the Rider or policy without prejudice to the rights of employees with respect to anything occurring while this Rider was in force.

LIFE INSURANCE

Life coverage can range from a flat sum to a percentage of your salary. In those instances, where the Life Benefit is a percentage of salary, when your salary or wage changes, your Life Insurance Amount will be changed on the first day of the month after the change, provided that Sagicor Life Inc. is notified in writing.

The amount of life coverage Sagicor Life Inc. will allow without medical evidence is called the Non-Evidence Maximum.

You may be eligible for coverage greater than the Non Evidence Maximum depending on the agreed terms within the Contract.

Evidence of insurability is required on amounts in excess of the Non-Evidence Maximum and any amounts in excess of the Non Evidence Maximum must be approved by Sagicor Life Inc. before coverage will take effect.

Your Life Insurance benefit will reduce by 50% at the age stated in your Schedule of Benefits. Your Life Insurance Benefit terminates at age 70 or Retirement, whichever is earlier.

Evidence of insurability is required on all amounts of insurance under the CariCARE® Enterprise product.

ACCIDENT DEATH & DISMEMBERMENT OPTIONAL RIDER TO LIFE Your Accidental Death & Dismemberment Optional Rider is equal to your Life Insurance amount and subject to the same requirements for evidence of insurability.

Your Accidental Death & Dismemberment Optional Rider terminates as stated in your Schedule of Benefits.

DEATH BENEFIT

If you die while covered, your Life Insurance amount will be paid to your Beneficiary. The amount payable will be the eligible amount at the time of death. See section on "HOW AND WHEN CLAIMS ARE PAID" for more details.

BENEFICIARY

Your beneficiary is the person or persons who will be paid if you die while covered. A person becomes your beneficiary when registered as such with Sagicor Life Inc.

You may change your beneficiary at any time by filling out a Change of Beneficiary Form. This form is available from your employer.

The form must be received and recorded by Sagicor Life Inc. before the change of beneficiary becomes effective.

Please ensure that your beneficiary designation is witnessed by one or two (2) witnesses where applicable.

ASSIGNMENT

You may not assign your Group Life Insurance benefits. This means you may not give or transfer your Group Life Insurance to anyone else.

CONVERSION PRIVILEGE

Conversion while policy is in-force

You may replace your Group Life Insurance with one of the several individual policies of Sagicor Life Inc. without proof of good health if your Coverage stops because your employment ends. You must apply within 31 days after coverage ends.

CONVERSION ON TERMINATION OF POLICY

In the event that this Policy is terminated an employee who has been continuously insured hereunder for 5 years or more immediately prior to such termination shall be entitled upon termination to the conversion privilege subject to the conditions and limitations in the contract.

BENEFITS IF YOU BECOME TOTALLY DISABLED

If you become Totally Disabled while covered and before your 60th birthday, your Life Insurance will continue for one year as long as you remain disabled. This insurance coverage will be at no cost to you. Waiver of Premium commences after six months of continuous total disability.

Your Life Insurance will then continue from year to year at no cost to you and without further premium payment while the disability continues and your group plan remains in force. You must meet all of these conditions:

- You are totally disabled for at least 6 months.

- Medical evidence shows that disability will be permanent.

- Written proof of disability must be given to Sagicor Life Inc. three months prior to the anniversary date of the disability. Sagicor Life will not ask for proof more than once a year.

If you do not give proof of continuing disability when it is requested, your insurance will end on the anniversary of the date you last gave proof.

If disability stops, your Life Insurance will end 31 days after the date your disability stops unless both of the following happen:

- You return to active employment with your employer.

- The Employer pays the premium for you.

If the Plan has any reductions in Life Insurance occurring at a certain age or time; the reductions will apply to you even if you are disabled.

Total disability insurance of an insured person terminates immediately at the earliest of the following dates:

- The date you cease to be disabled;

- The date on which your insurance would normally cease if you were not totally disabled or the age as set forth in the Schedule of Benefits whichever is earlier;

- The end of period for which insurance has been continued during which you fail to furnish proof of continuance of total disability;

- The date you refuse to be examined by a physician or health care professional designated by Sagicor Life Inc.;

- The date your policy terminates.

ACCIDENTAL DEATH & DISMEMBERMENT RIDER

ACCIDENTAL DEATH and DISMEMBERMENT

If an employee's death is as a result of an accident, and they are covered for Life and accidental death and dismemberment, the beneficiary will be entitled to receive the Life insurance benefit as well as the Accidental Death & Dismemberment benefit. This benefit is also paid if an accident causes you to lose any limbs or sight in one or both eyes.

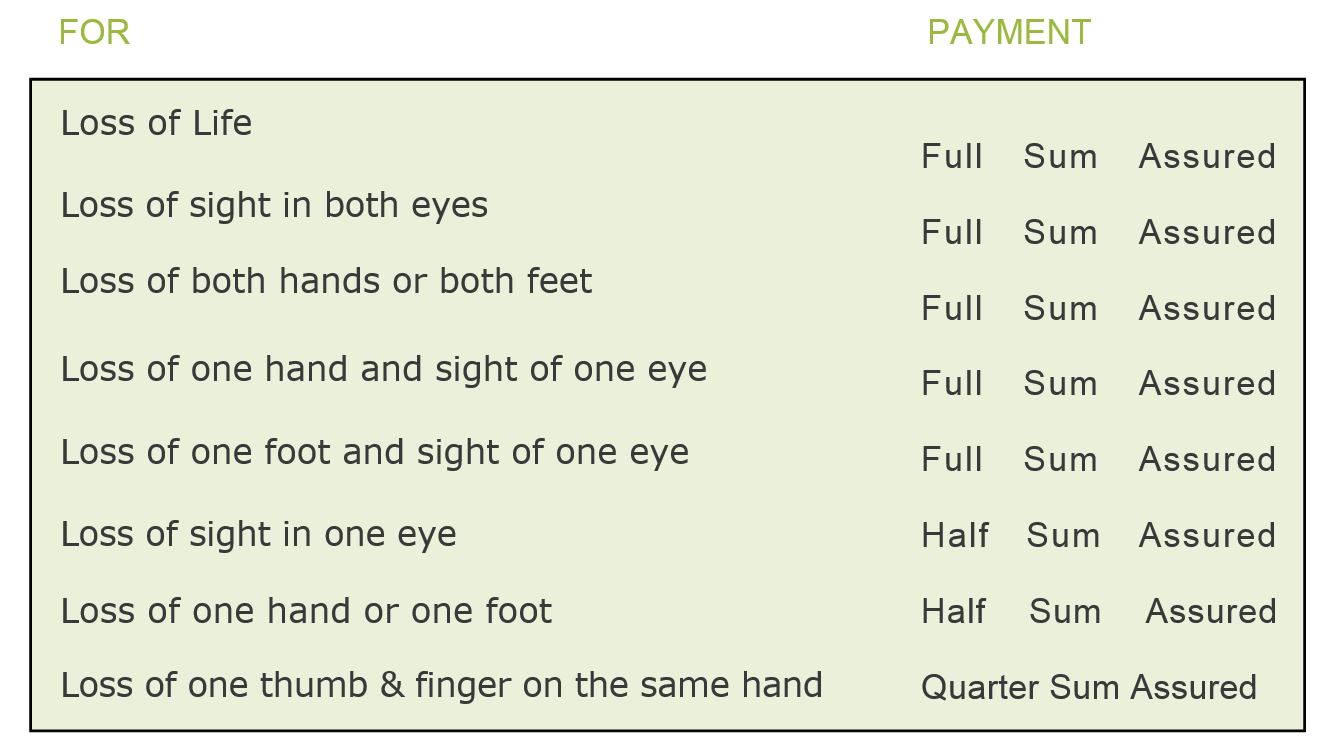

PAYMENT is made as follows:

- Loss of a hand means removal at or above the wrist joint.

- Loss of a foot means removal at or above the ankle joint.

- Loss of an eye means total loss of sight, which cannot be recovered.

- Loss of thumb and finger means removal at or above the knuckles joining the thumb and finger to the hand.

The Accident Benefit is shown in the schedule above. Only one Benefit, the highest, will be paid if you suffer more than one loss in an accident.

Benefits for loss of life will be paid to your beneficiary. This is in addition to your Life Insurance Benefit. Benefits for other losses will be paid to you. See section on "HOW AND WHEN CLAIMS ARE PAID" for more details.

ACCIDENTAL DEATH BENEFIT

Your policy must cover Accidental Death and Dismemberment in order for you to qualify for this benefit.

You may name one or more persons as your beneficiary. Your beneficiary is the person or persons who will be paid if you die while covered.

A person becomes your beneficiary when registered as such with Sagicor Life Inc.

You may change your beneficiary at any time by filling out a Change of Beneficiary Form. This form is available from your employer.

NOT COVERED

No payment will be made under this benefit for:

- Loss occurring more than 365 days after the accident resulting in the accidental injury.

- Loss resulting directly or indirectly from:

- physical or mental infirmity or illness or disease of any kind;

- ptomaine or bacterial infection other than septic infection occurring simultaneously with and solely in consequence of an accidental injury;

- suicide or intentionally self-inflicted injury or any attempt thereat while sane or insane;

- police duty or service in any military naval air or any armed force of any country whether war be declared or not;

- war invasion act of foreign enemy hostilities (whether war be declared or not) riot civil war civil commotion insurrection rebellion revolution act of military or usurped power strike or any act incidental thereto;

- participation or engagement in any submarine expedition or operation or in aeronautics, or contact sports, whilst driving or riding in any race or in travel by ship or aircraft (including ascent and descent) operated by a regular carrier other than as a ticket holding passenger;

- violation of the law or any attempt to violate the law;

- capital punishment;

- an accident which occurs while the blood alcohol level of the life assured is 80 milligrams or more per 100 milliliters of blood;

- inhalation of gas or fumes of any kind (whether voluntary or otherwise) resulting in poisoning asphyxiation or any other concoction;

- poisoning or infection other than infections occurring simultaneously with and in consequence of an accidental injury;

- intentional use of legal and illegal drugs;

- accidental injury or death where there is no visible contusion or wound to the exterior of the body except death caused by drowning or internal injuries revealed by autopsy;

- injury for which the employer is liable under the laws governing workmen's compensation unless 24-hour coverage is noted in the accidental injury or death where there is no visible contusion or wound to the exterior of the body except death caused by drowning or internal injuries revealed by autopsy;

Coverage terminates on the date of termination of the policy or at any time your employer gives written termination of this coverage.

HOW TO FILE A CLAIM

Claim Forms are available from your employer or from Sagicor Life Inc. This Form should be thoroughly completed and accompanied by all relevant information relating to the claim.

A health claim may also be processed electronically by swiping your CariCARE® card at specific providers. Online claims settlement is available to all covered employees and allows insured persons to have their health claims settled 'real time', right at the health-care provider's office. Employees will be required to pay to the Provider only his/her portion of the liability. Through this system, the completion of health claim forms will not be required.

INTERNATIONAL MEDICAL CARD

Being a CariCARE® Plan Member you are provided with a Medical Card that affords you enhanced protection against emergencies while traveling or assistance for overseas treatment by Pre-Arrangement with Sagicor Life Inc. Your card ensures that all your eligible medical bills related to your emergency anywhere in the world are paid. A single phone call activates a series of events that lead to prompt and efficient medical care that can help you and your dependents in an emergency.

The CariCARE® out of country treatment while traveling provides access to Sagicor's overseas medical intermediary, Europ Assistance (formerly CMN), and provides access to a wider network of healthcare providers both locally and internationally.

CariCARE® Group Plan members travelling overseas will also benefit from the extensive Aetna provider network. Aetna is a Preferred Provider Organization (PPO) and has agreements with several providers which form the network. The co-branded CariCARE® cards will facilitate recognition and easy access by Sagicor customers to Aetna listed healthcare providers.

ONLINE CLAIM SETTLEMENT PROCESS

Our innovative upfront process has made the claims settlement process faster and easier for Sagicor customers.

Step 1

The Sagicor Group Health customer presents their card at any participating provider.

Step 2

The card is swiped and the customer is deemed eligible. The provider then informs the customer what amount Sagicor will cover and how much remains for the customer to pay.

Step 3

Sagicor pays the provider directly on the customer's behalf.

Look for the Sagicor logo at participating providers including your local pharmacy, general practitioner, specialists, diagnostic and laboratory facilities and vision providers.

GENERAL PROVISIONS

CO-ORDINATION OF BENEFITS

You or any Dependent may be covered under another group health plan. It may be sponsored by another employer who makes contributions or payroll deductions for it. It could be a government or tax-supported program.

Whenever there is more than one plan, the total amount of benefits paid in a Calendar Year under all plans cannot be more than the expenses charged for the Calendar Year.

One of the plans involved will pay the benefits first, (this is called the Primary Plan). The other plans will then make up the difference up to the total reasonable expenses incurred, (these plans are called Secondary Plans).

NO plan will pay more than it would have paid without this provision.

In order to pay claims, Sagicor Life Inc. must find out which plan is Primary and which plan is Secondary. A plan will pay benefits first if it meets one of the following conditions:

- The plan has no Co-ordination of Benefits provision.

- The plan covers the person as an Employee.

- As a dependent child of a parent who has been awarded sole custody of the dependent by a Court of competent jurisdiction.

- The plan covering the Insured as a dependent of a male Employee determines its benefits before a plan covering him as a dependent of a female Employee.

- When none of the above apply, the plan covering the person for the longest time pays first.

You will have to give information about any other plans when you file a claim.

If Sagicor Life Inc. is the Primary Insurer, you must submit the original receipt along with a copy of the said receipt, in order for the original receipt to be returned to you for submission to your Secondary Insurer.

LIFE AND ACCIDENTAL DEATH BENEFITS

Your Employer should be notified as soon as possible after a death.

The Insurance Company can request an autopsy in connection with a claim for death under the Accidental Benefit except where it is not permitted by law.

Other claims for losses under the Accidental Benefit should be filed within 365 days from the date of the loss, if it is not possible to file the claim within 365 days, Sagicor Life Inc. should be notified of the pending claim.

WAIVER OF PREMIUM

Sagicor Life Inc. should be notified as soon as possible after you have become disabled or not more than twelve (12) months thereafter.

HEALTH BENEFITS

To claim health benefits, you must give Sagicor Life Inc. written proof of your loss within 90 days after the date the expenses are incurred. If it is not possible to file the claim within 90 days, Sagicor Life Inc. should be notified of the pending claim.

It is important to keep separate records for each person in your family since maximum amounts; deductible amounts and other provision apply separately to each person.

- Be sure to save all bills, receipts and attach original with copies to the claim form. Keep a record of the date of service and the type of service given.

Sagicor Life Inc. has the right to examine anyone filing a claim.

HOW AND WHEN CLAIMS ARE PAID

Death and Accidental Death

Your Life Insurance and Accident Death Benefit will be paid in one amount.

You can get more information about this from your Employer. These benefits will be paid to your beneficiary immediately after Sagicor Life Inc. receives due proof of death.

Payment of any part of the insurance for which there is no beneficiary named or still living at your death will be made to your estate.

ACCIDENTAL DISMEMBERMENT AND LOSS OF SIGHT

All other benefits for a loss from an accident will be paid to you immediately after Sagicor Life Inc. receives satisfactory proof of loss.

HEALTH BENEFITS

All benefits will be paid to you within 10 working days after Sagicor Life Inc. receives satisfactory proof of loss.

HOW TO APPEAL A CLAIM

You will be notified in writing by Sagicor Life Inc. if a claim or any part of a claim is denied.

- If you are not satisfied with the explanation of why the claim was denied you may ask to have your claim reviewed.

- If you think you have more information that can help your claim you can send it with your request.

You can ask for and receive copies of documents important to the claim. In some cases, approval may be needed to release confidential information such as medical records. You may submit issues and comments in writing. A decision will be made within 60 days after receipt of request for review or the date all information required from you is given.

Sagicor Life Inc. will notify you in writing about the decision on your review. The reasons for the decision will be stated in a manner you can understand.

WHEN COVERAGE STOPS

YOUR COVERAGE

Coverage will stop on the earliest of the following:

- The last day of the month in which your employment ends.

- The last day of the month in which you stop being an eligible

- When the Group Policy stops.

- On the attainment of the age as set forth in the Schedule of Benefits.

YOUR DEPENDANTS COVERAGE

Coverage for all of your Dependents stops when your coverage stops or when you stop making contributions.

Coverage for an individual Dependent stops if one of the following happens:

- The Dependent becomes covered as an Employee under this plan.

- The Dependent stops being an eligible Dependent.

HANDICAPPED CHILDREN

A mentally or physically handicapped child's health coverage will not stop due to age. It will continue as long as your Dependents coverage continues and the child continues to meet the following conditions:

- The child is handicapped.

- The child is not capable of self-support.

- The child depends mainly on you for support.

You must give Sagicor Life Inc. proof that the child meets these conditions when requested. Sagicor Life Inc. will not ask for proof more than once a year.

BENEFITS AVAILABLE AFTER COVERAGE STOPS

ACCIDENTAL BENEFIT

Sagicor Life Inc. will pay:

- Accidental Benefits if the accident happened while covered. The loss must be due to the accident. The loss must happen within 365 days after the accident.

COMPREHENSIVE MEDICAL BENEFIT

Sagicor Life Inc. will pay:

- Benefits for the 12-month period after coverage stops, as long as the following conditions are met:

- The person is Totally Disabled due to the same cause for the entire time from when coverage stops.

- The expenses are not payable under any other group plan.

Benefits are payable only for charges made for the accidental injury, sickness or pregnancy which caused the Total Disability.

DEFINITIONS

These definitions apply when the following terms are used in this Booklet:

Accident

An inadvertent bodily injury which is caused by an event which is sudden and unforeseen and exact as to time and place of occurrence.

Allowable Expense

Any necessary, usual, reasonable and customary expense actually charged to the person for whom a claim is made and for which at least a portion is a covered expense under any one of the plans that cover the person for whom a claim is made. In some circumstances the maximum allowable expense for a service or treatment may be set out specifically in the Schedule of Major Medical Benefits.

Calendar Year

The period of time which begins on any January 1st and ends on the following December 31st.

Chiropractor

A health care professional duly certified and licensed to provide chiropractic care in the jurisdiction where such care is given.

Covered Family Members

You and your wife or husband and Dependent children who are covered under this plan.

Complications of Pregnancy:

- hyperemesis gravidarum, pre-eclampsia and toxemia with convulsions during hospital confinement;

- ectopic pregnancy, if no specified amount is indicated for extra uterine pregnancy under the Maternity Benefit portion of the Schedule of Major Medical Benefits;

- a condition requiring medical treatment prior or subsequent to termination of pregnancy the diagnosis of which is distinct from normal pregnancy but which is adversely affected by pregnancy or is caused by pregnancy, such as acute nephritis, nephrosis, cardiac decompensation, missed abortion, disease of the vascular, hemopoietic, nervous or endocrine systems and similar medical conditions of comparable

Dependent

- The husband or the wife of an employee who is either cohabiting in the same household with the employee or has not been living in a country other than the one in which the employee resides for a period exceeding 6 months (in this Policy called "a spouse");

- a man who is cohabiting in the same household with a female employee as the spouse of such employee, or a woman who is cohabiting in the same household with a male employee as the spouse of such employee for not less than 5 consecutive years provided that cohabitation shall not be deemed to have ceased if the spouse has been living in a country other than the one in which the employee resides for a period not exceeding 6 months (in this Policy called "a spouse");

- a child of an employee whether born in or out of wedlock (including a stepchild, foster child or legally adopted child) who:

- is not or has never been married and is not living or has never lived with another person as his or her spouse; and

- is wholly or mainly maintained by the employee; and

- has not attained the age of 19 years and resides in the same country as the employee or has attained the age of 19 years but not the age of 25 years and is a full-time student at a school college university or institution of vocational learning (herein called the "institution") in which case coverage commences on the date satisfactory evidence of such attendance and maintenance is approved by the Insurer and continues provided that such evidence is thereafter furnished by the employee to the Insurer annuall Satisfactory evidence of insurability is required for all such students applying for coverage after 31 days from the date of acceptance to the institution; or

- because of some mental or physical disability is incapable of maintaining himself and in the case of a child who has attained the age of 19 years, evidence of such incapacity is furnished to the Insurer within 31 days of the child attaining such age and subsequently as may be required by the Insurer but not more than once a year after the 2 years immediately following the attainment by the child of 19

Employee

If the Policyholder is an employer, a person who is permanently employed by the Policyholder under a contract of service and who usually works a minimum of 30 hours each week and may include if the Policyholder is a proprietor or partnership the proprietor or partners where such persons usually work for a minimum of 30 hours each week. If the Policyholder is an association, board of trustees, board of management or union "employee" includes a member in good standing who is eligible for insurance under the rules pertaining to such insurance issued to such Policyholder. Where in the application form (which forms part of this Policy) retired persons are insured hereunder "employee" also includes a person who has retired from employment with the employer. In all instances the "employee" must be ordinarily resident in the country in which this Policy is issued.

Employer

The Policyholder or any of the Policyholder's affiliated companies listed in the Schedule of Affiliated Companies which forms part of this Policy.

Hospital

Means a medical treatment facility operated pursuant to law for the care and treatment of sick and injured persons, with organized facilities for diagnosis and major surgery, and which provides a 24-hour general nursing service. The term "hospital" shall not be construed to include a hotel, rest-home, convalescent home, place for custodial care, home for the aged or a place used primarily for the confinement or treatment of persons who have been engaging in substance abuse.

Illness or sickness

A disease or medical condition that does not arise out of and is not caused by nor contributed to or as a consequence of any disease or medical condition that arises out of or in the course of employment or occupation for compensation or profit.

Intensive Care Unit

A special unit of a hospital which treats patients with only the most serious of sicknesses or injuries, provides constant observation of patients by a specially trained nursing staff and which can provide specialized lifesaving methods and equipment.

Medically Necessary or Medical Necessity

A medical service, supply or medicine is necessary and appropriate for, and consistent with, the diagnosis or treatment of an illness or injury based on generally accepted current medical practice. Without limiting the generality of the foregoing, a medical service, supply or medicine will be considered medically necessary if:

- it is an appropriate and essential treatment for the insured's diagnosis or symptoms;

- it is not in excess (in scope, duration or intensity) of that level of care which is needed to provide safe, adequate and appropriate treatment;

- it is not part of a treatment plan that is considered to be experimental or for research purposes;

- the diagnosis or treatment of the ill ness or injury is in accordance with generally accepted current medical practice, based on consultation with an appropriate service;

- it does not involve the use of any drug or substance not formally approved by the Food and Drug Administration of the United States of America, whether or not such approval is required;

- it is not provided primarily as a convenience to the patient or the provider of

Mental illness

Means neurosis, psychoneurosis, psychopathy, psychosis, or mental or emotional disease or disorder of any kind.

Nurse

Means an individual who is licensed by the government as a qualified nurse and duly registered to practice nursing in the jurisdiction where such services are given and who is not a relative of the insured.

Other Services and Supplies

Services and supplies furnished to the individual and required for treatment, other than the professional services of any physician and any private duty or special nursing services (including intensive nursing care by whatever name called).

Physician

Means a licensed doctor or surgeon duly registered to practice medicine and qualified to render the treatment provided in the jurisdiction where such treatment is given.

Policyholder

Means the employer or the association or the board of trustees or the union entering into contract with the Insurer under the terms of this Policy and so named on the cover page of this Policy.

Private Duty Nursing

Means medically necessary nursing care to assist with rehabilitative management of a patient on a short term bas is not exceeding 120 days, and excludes the provision of assistance with daily living.

Reasonable and Customary Charges

Shall be deemed to refer to a charge for any health care treatment, service or supply which shall be considered reasonable and customary to the extent that it does not exceed the general level of charges being made by other providers or suppliers of similar standing in the locale where the charge is incurred when furnishing like or comparable treatment, service or supplies to persons of the same sex and of comparable age and circumstance for a similar illness or injury. In determining that amount which constitutes a reasonable and customary expense the Insurer will use information available from insurance sources and factors as adopted from time to time by the insurance industry in the manner then applied by the Insurer. Where no industry figure is available the determination will be based on the Insurer's established practice at the time.

Room and Board

Means al l charges made by a hospital for accommodation and meals and general duty nursing and any other services regularly furnished by the hospital as a condition of occupancy of the particular class of accommodations occupied by the patient but not including professional services of any physician or other health care professional or any private duty nursing or special nursing services nor any medicines or supplies furnished to the patient while hospitalized.

Total Disability

Means being wholly and continuously disabled by sickness or accidental bodily injury which, in the case of an employee, prevents him from working for any remuneration or profit, and which, in the case of a dependent, prevents such dependent from engaging in al l the normal activities of a person of like age and sex who is in good health.